As more brands chose to sell direct to consumer, private labels have emerged as a critical piece of a retailers assortment, and those capitalizing on the trend have done well this year. The private-label market once was largely driven by demand from lower-income shoppers. Then came budget-conscious millennials. Now, wealthier consumers are going for private labels as well, tightening the squeeze for national brands.

Half of Consumers Expect to Buy More Private Label

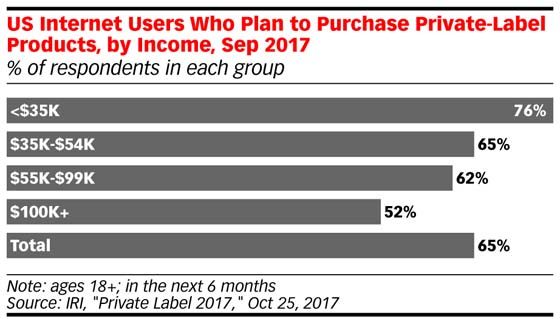

A September survey by IRI found that more than half of consumers with household income of more than $100,000 said they expect to buy more private-label products over the next six months.

Private Label Presents Big Risk to Brands

Private label allows retailers to provide an experience that can’t be easily replicated. An essential trend for 2018 will be seen with winning retailers looking to cultivate and promote their private label brands more aggressively. Amazon in particular has pushed deeply into this area — in a bigger way than previously thought. The e-commerce giant now has 41 private label brands and expanding. Private labels are a huge risk factor for manufacturers who will struggle to maintain equity in brands they have built over time.

Private labels will come from large retailers capable of buying inventory on mass and have the marketing power to promote the brand and utilize their storefronts to encourage trial and habitual purchase. Those in categories with independent retailers will find more overseas manufacturers develop their own private label programs to compete as the power shift moves from brand to manufacturer in a direct to consumer only world with more small players and a democratized playing field.

Private Labels Forcing Brands to do More with Less

Brands need to acknowledge two facts:

- Customer experience is the new currency of retail

- Accept a lower level of profitability in delivering those experiences.

Pure-play online only brands will be the most vulnerable to the risks private label products impose as online consumers cannot gauge the quality differences or have the product knowledge of someone to explain the differences often instead selecting based on price and consumer reviews which may or may not be authentic. The D2C approach will create openings for new entrants and experiential brands who believe the physical World can differentiate their brand will win.

It’s Not All About Online Sales

Retail is changing quickly but it’s not all online. Many consumers including next generation Millennials and Gen Z prefer to browse offline. Coupled with the fact that those who shop across online and physical channels spend more and 90% of all retail sales still occur in stores it is not a channel to turn your back on as it can make your product standout from a private label alternative.

What forces brick and mortar to consider private labels is a lack of loyalty and damaged retail relationships. As most manufacturers are exploring a direct to consumer approach, it is causing a channel conflict effectively competing with their brick and mortar retail channel. In most cases these retailers put food on the table for brands by buying product in advance to expose your products to new consumers.

How Can Brands Win?

- Giving retailers the tools to be successful with your products will encourage loyalty and ensure your products have a prominent position on the showroom floor and become known amongst sales associates. Tools to consider include a Retail as a Service platform and on demand B2B Commerce ordering.

- Offline consumer experiences that create community and make customers feel an affinity towards your brand. The online channel is definitely growing and should not be ignored by any manufacturer but those who forego the benefits brick and mortar provide as it morphs toward experiential retail will miss out on the next era of retail.

Conclusion

In an increasingly competitive World covering all your bases to maintain your position in store and snuff out new entrants is rising in importance. As online advertising and customer acquisition costs rise for online only players, the relationships at retail will determine whether or not you open the door for a new competitor to get discovered and bought from. Online only does not differentiate your brand from anyone else on the market but offline consumer experiences can.